To Educate and Inform You.

The Price Behind The Pump

California's Gas Prices Explained.

Check out our Instagram for more content!

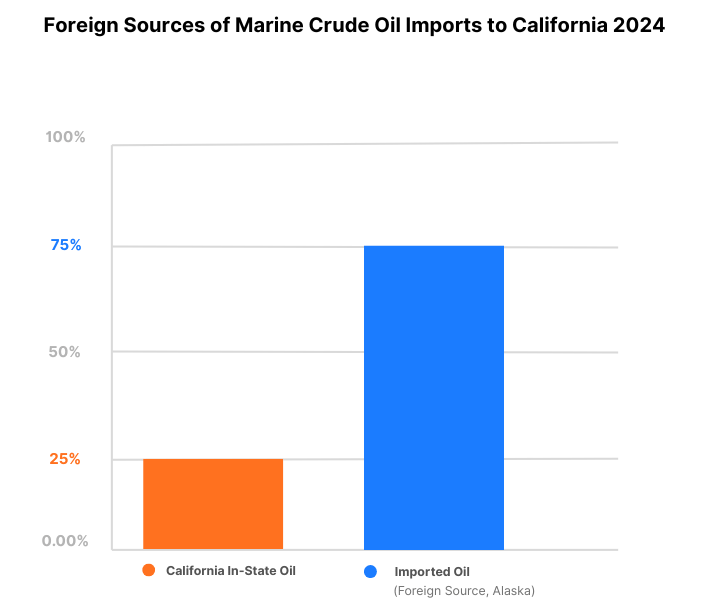

Relying heavily on imported fuel not only makes fuel prices volatile but also introduces substantial risks to the overall energy supply chain. This dependence exposes the economy and energy infrastructure to a range of vulnerabilities, including heightened supply chain disruptions, increased sensitivity to fluctuations in global oil prices, and greater susceptibility to geopolitical tensions that can affect fuel availability. Additionally, a heavy reliance on foreign sources limits domestic alternatives and backup options, reducing resilience in the event of supply interruptions or crises. Together, these factors create a more uncertain and potentially unstable energy landscape.

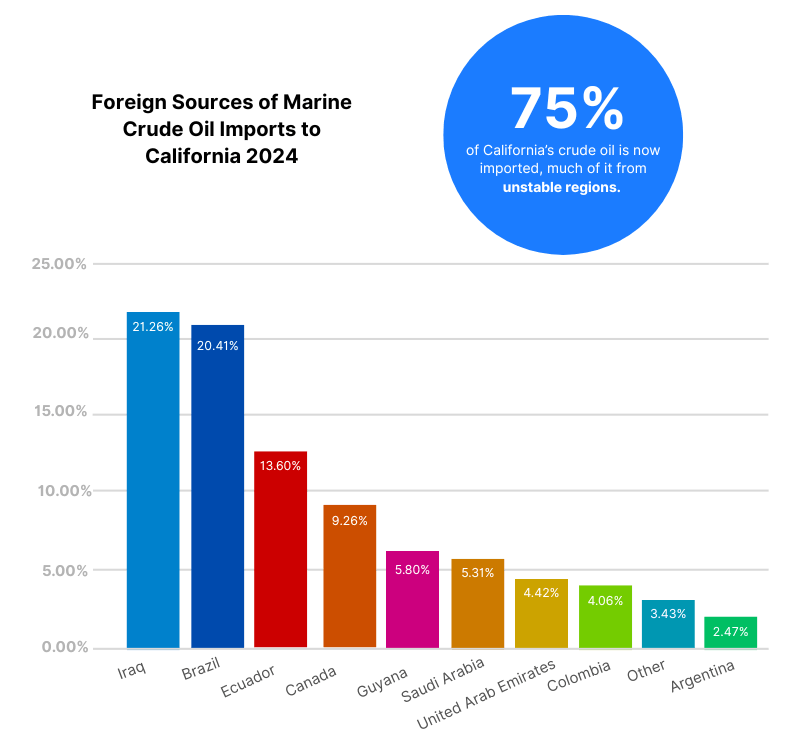

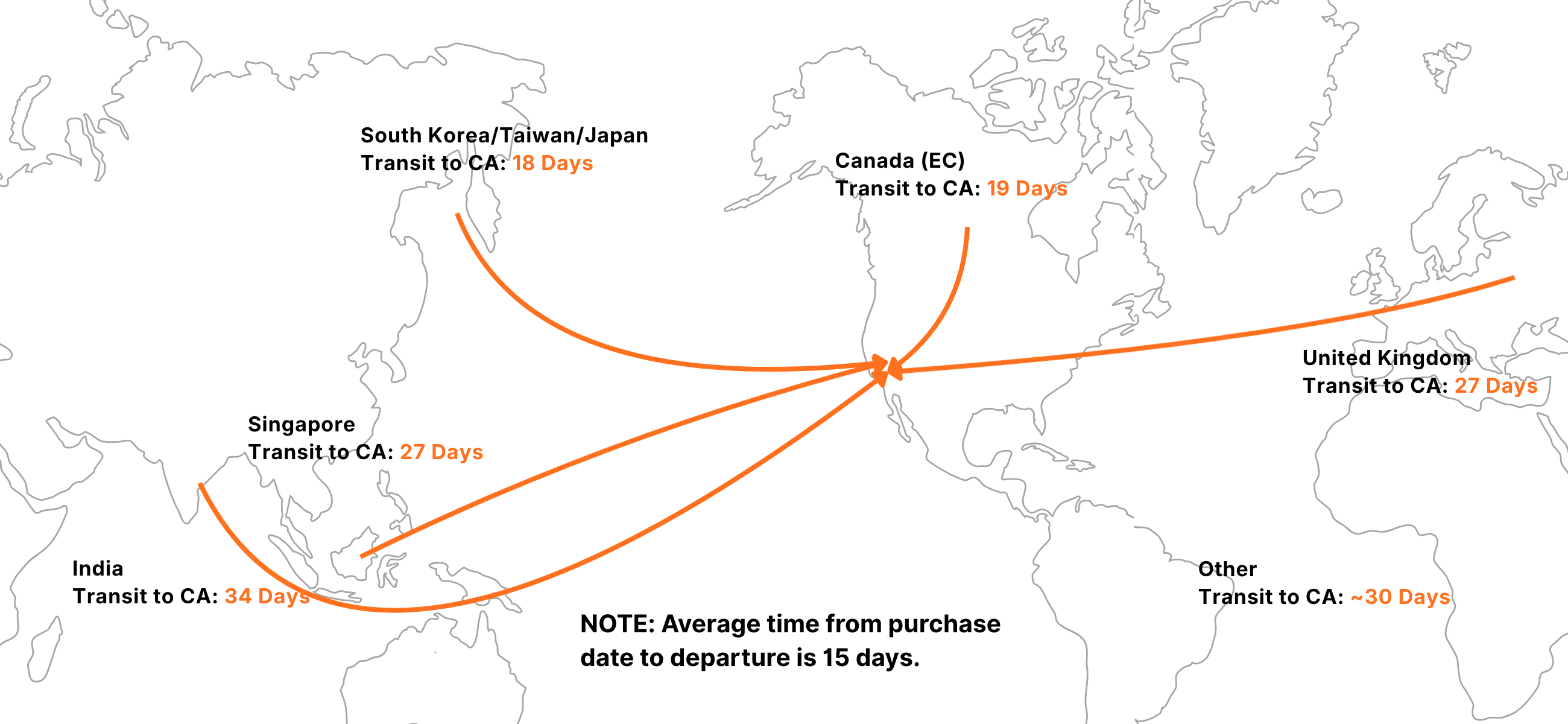

Where CA Imports Its Oil From

Today, more than 75% of California’s crude oil is sourced from outside the state, and a large portion of these imports originates from regions that are politically unstable or prone to economic disruption.

This heavy dependence on foreign crude not only makes the state more vulnerable to sudden changes in global oil prices but also increases the risk of supply interruptions due to conflicts, trade disputes, or natural disasters in those regions.

Credit to the California Energy Commission.

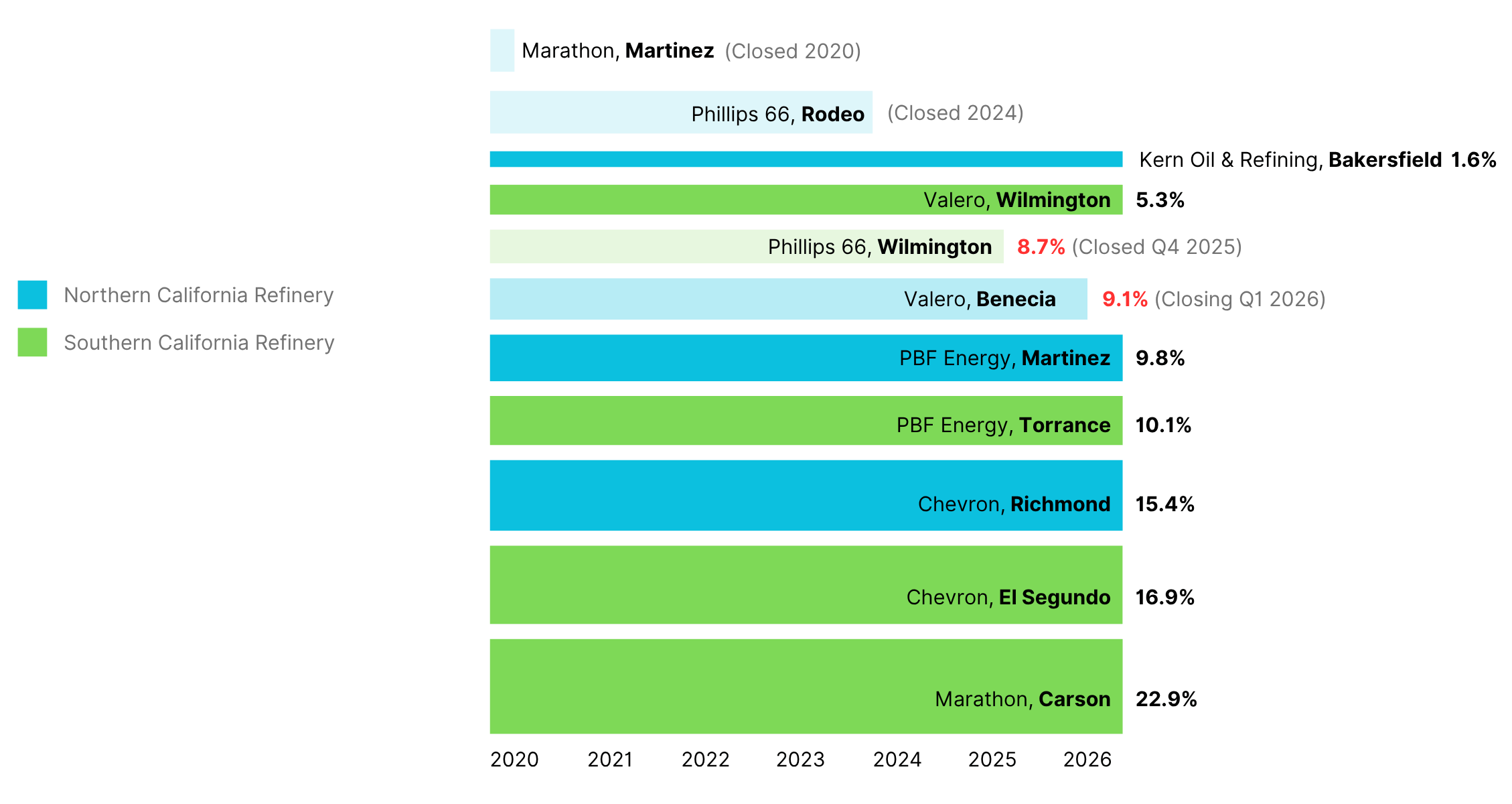

Losing Refining Capacity

With P66 Wilmington now closed, and Valero Benecia set to close in Q1 of 2026, the loss of these two major refineries could remove up to 20% of in-state refining capacity.

Closing these refineries would phase out many well-paid, skilled jobs without sufficient retraining programs in place, creating a substantial risk of widespread job disruption.

Most fuel-related jobs (many unionized) would disappear with no transition plan. The city of Benicia faces a potential loss of $10-$20 million annually in city revenue and thousands of high-wage jobs due to the potential closure of the Valero refinery, a closure driven largely by California's regulatory environment.

Oil and Gas workforce will DECLINE and an estimated $53 billion in labor income and $166 billion in economic activity are at risk of being lost.

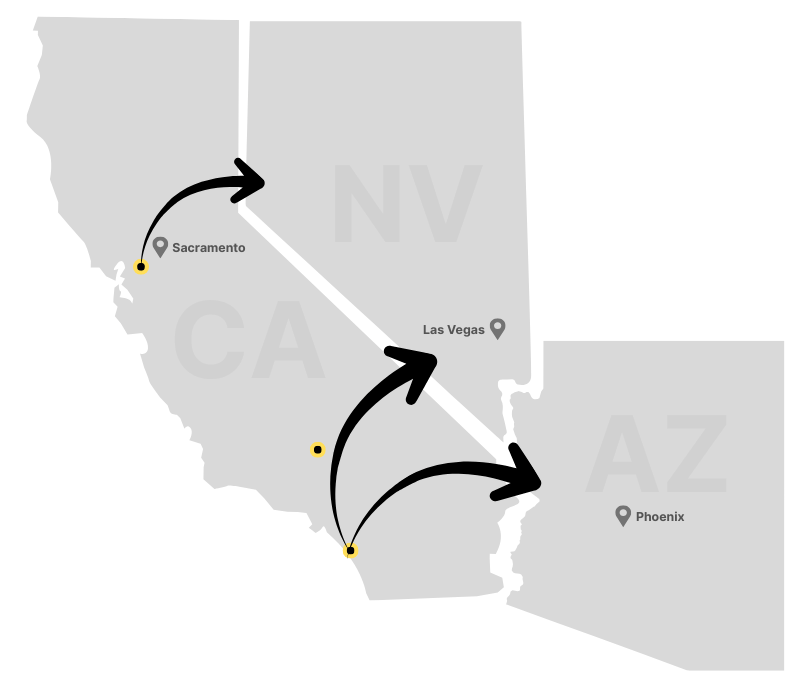

California Is A Fuel Island

California has no inbound fuel pipelines, making this state a "fuel island." The state's specialized gasoline blend isn't produced anywhere else in the contiguous U.S., so it must be refined within California or imported from abroad.

Depending on the country that the refined oil is being imported from, it can take 10-34 days to deliver, not including the 15-day processing time. Meeting these unique fuel standards is costly, complex, and time-consuming.

How California Gas Gets Made

[Special thank you to Chevron El Segundo for this detailed explainer]

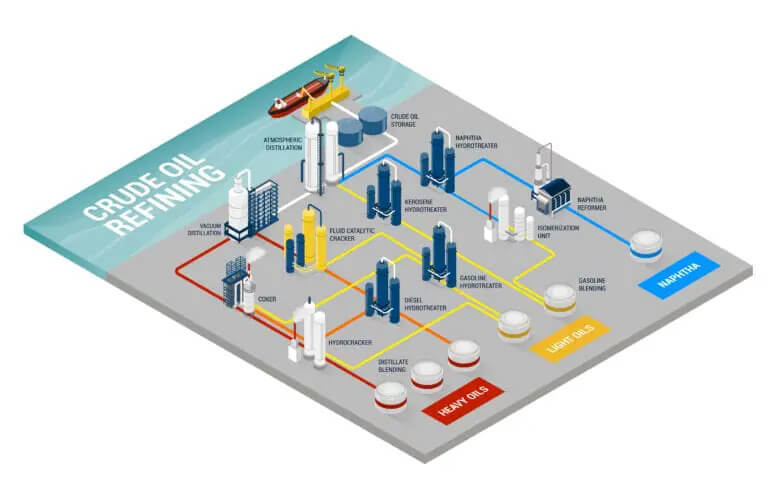

Chevron El Segundo is committed to producing the finest fuels through its refining process. Whether pumped through pipelines or shipped thousands of miles in tankers, crude oil arrives at our refinery in its rawest form.

It is the job of the people who work here to convert that crude oil into fuel we can use - gasoline for cars, jet fuel for airplanes, diesel for trucks and trains, propane and butane for home heating and barbecues, and fuel oils, coke, and certain chemicals for industrial use.

The refining process begins in the distillation towers, where liquids and vapors are separated by weight and boiling point. Lighter, high-value fuels are separated from heavier products. Most outputs then undergo hydrotreating, where hydrogen removes sulfur and nitrogen. The recovered sulfur is sold for industrial use, nitrogen is converted to ammonia for fertilizer or returned to harmless nitrogen gas, and captured carbon dioxide is used in applications like beverage carbonation.

Only about 40% of crude oil consists of high-quality fuel components; the rest are heavy, low-performing fuels. These heavy fractions are transformed into usable transportation fuels through a process called cracking, which breaks large molecules into smaller, usable ones.

At the Chevron El Segundo Refinery, which provides 20% of Southern California’s motor fuel and 40% of its jet fuel, three main types of cracking units are used to produce these essential fuels.

The Coker is a thermal cracking unit. It heats the heaviest portion of the crude to a high temperature, causing it to crack into lighter materials.

The light materials produced are gasoline, jet fuel, and diesel.

The light fuel boils off, leaving behind a soild coal-like material called petroleum cake.

Petroleum coke is transported to the Port of Los Angeles, where it is shipped to Asia and Europe to be used in heating and manufacturing.

The Fluidized Catalytic Cracking Unit (FCC), or "cat cracker," cracks the heavy material into gasoline, the most demanded transportation fuel.

The Hyrdocracking Unit is another catalytic cracking unit. Chevron's patented hydrocracking process is called an ISOMAX Unit. The catalyst in the ISOMAX unit is designed to crack heavy material into jet fuel.

After the molecules have been cracked, these fuels are still not ready to power an automobile or jet engine. The molecules must be arranged and rearranged to burn cleanly and with better performance.

Credit to Chevron: https://elsegundo.chevron.com/our-businesses/the-refining-process

The Catalytic Reforming and Alkylation processes all result in higher octane fuels which are designed to meet these needs.

Finally, after more than 200 hydrocarbons and additives have been blended into the fuel, the finished products are held in storage tanks, ready to be shipped via tanker, truck, or pipeline to our customers.

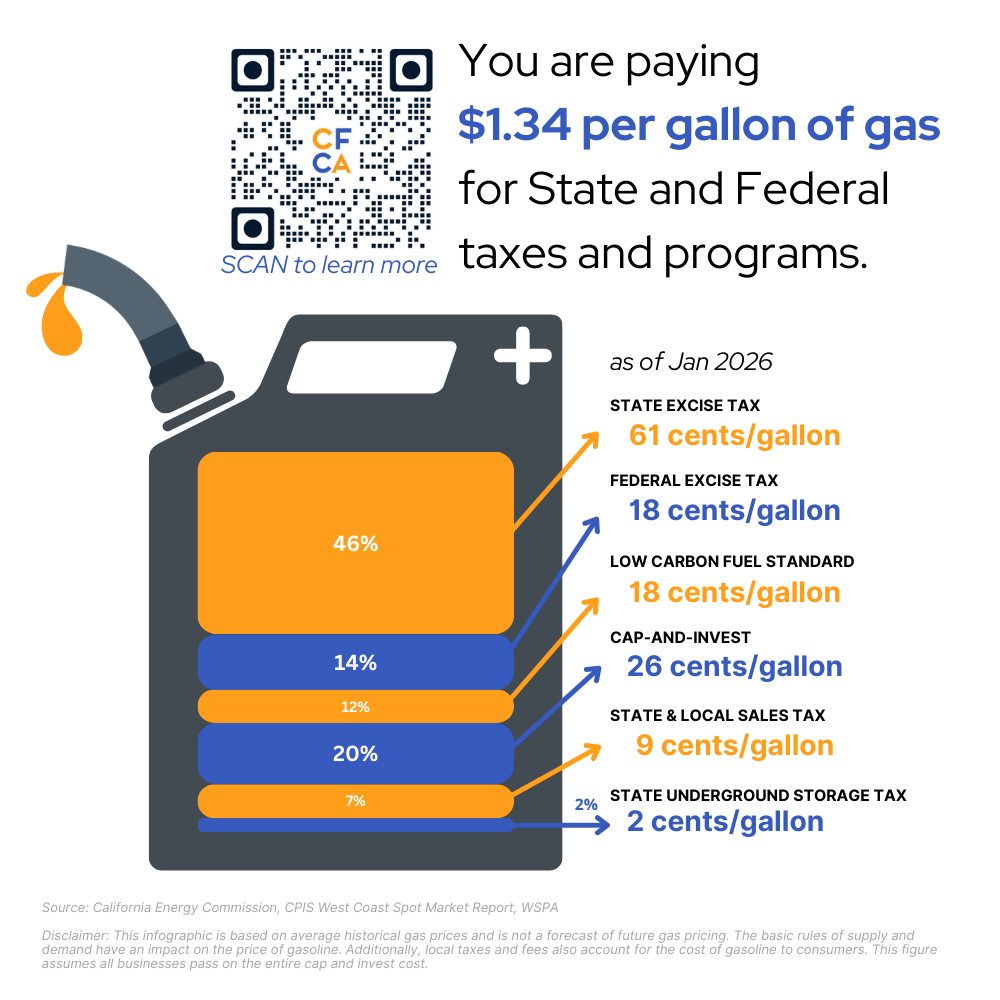

As of July 1, 2025, California’s gasoline excise tax rose to 61.2 cents per gallon, up from 59.6 cents, reflecting the state’s annual inflation adjustment.

Additionally, California regulators advanced a proposal that could increase gas prices by up to ~65 cents per gallon in the coming years, linked to updates in the Low Carbon Fuel Standard (LCFS). These price changes aren’t driven by global oil markets, they result from policy decisions made right here in Sacramento.

What Is LCFS? Why You Should Care.

The Low Carbon Fuel Standard (LCFS) is a program managed by the California Air Resources Board (CARB) that aims to reduce greenhouse gas emissions by requiring fuel providers to meet "carbon intensity" targets.

CARB adopted new, more stringent standards, and economists predict these changes could increase gas prices by up to 65 cents per gallon or more - all without a clear plan to protect working families or small businesses.

And these decisions were made without direct legislative approval - meaning unelected regulators are driving up fuel costs without input from the public or their representatives.

There are three main categories that make up the price of gas in California. These buckets include the cost of the fuel itself, the costs associated with refining and distributing it, and the taxes and fees imposed by the state. Together, these factors determine what drivers pay at the pump.

Many individuals are surprised to learn that California is widely regarded as the most heavily regulated state in the country. Spanning areas such as housing, environmental oversight, business operations, and labor standards, the state’s comprehensive and intricate regulatory framework distinguishes it at the national level.

In this section, you will be introduced to the primary agencies and departments that shape these regulations, along with the key rules and requirements important to understand.

California's Regulatory Environment

As a notable example of the state’s extensive oversight, take a moment to review the broad array of regulatory agencies and departments that establish, implement, and enforce requirements within California’s fuels industry.

That's 45 TOTAL agencies!

If you are interested in understanding the nature of these rules and regulations, we have identified a small sampling from the hundreds our industry must comply with each day.

These examples demonstrate the many external factors, beyond our direct control that influence and ultimately increase the price of gasoline:

That's only 39 rules and regulations of the HUNDREDS that exist!

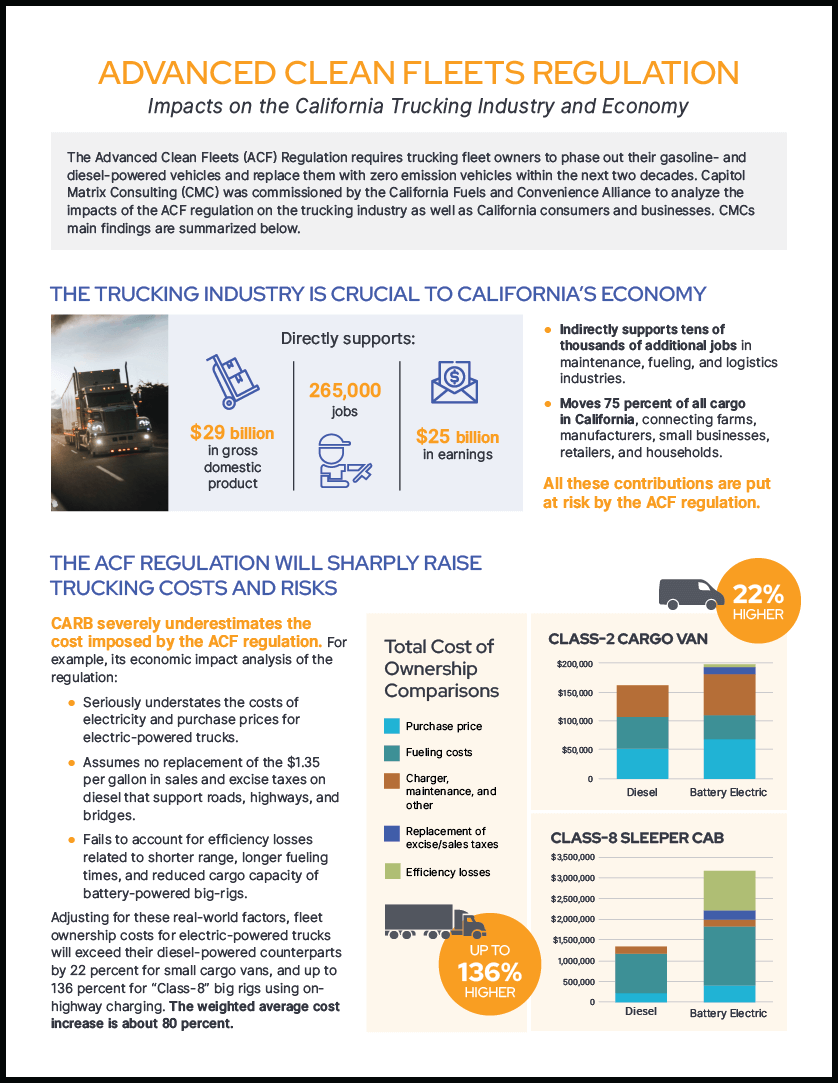

What California's Heavy-Duty Truck Mandate Means for Prices, Freight, and California Families

Written October 2024

Among the many regulatory requirements that shape our industry, one of the most controversial was the Advanced Clean Fleets (ACF) Regulation.

Adopted in April 2023, this rule would have mandated the gradual phase-out of gas- and diesel-powered trucking fleets in California, with the goal of transitioning to zero tailpipe-emission vehicles by 2042. It would have required trucking companies to incrementally adopt electric trucks beginning in 2026 in order to support the state’s broader objective of achieving net-zero emissions by 2045. Since the rule did not receive a waiver from the US EPA, it is not enforceable for private fleets, but still applies to public fleets.

Read the key findings HERE

Locally owned gas stations and convenience stores are essential to communities across California. Unlike major oil corporations, these independent businesses are operated by entrepreneurs and family-run enterprises who handle daily operations, serve their neighbors, and navigate a complex regulatory landscape. Many of these establishments have been passed down through generations, reinforcing their deep roots in the community. In addition to supporting local economies, they provide Californians with convenient access to essential goods and services close to home.

Small Businesses, Not Big Oil

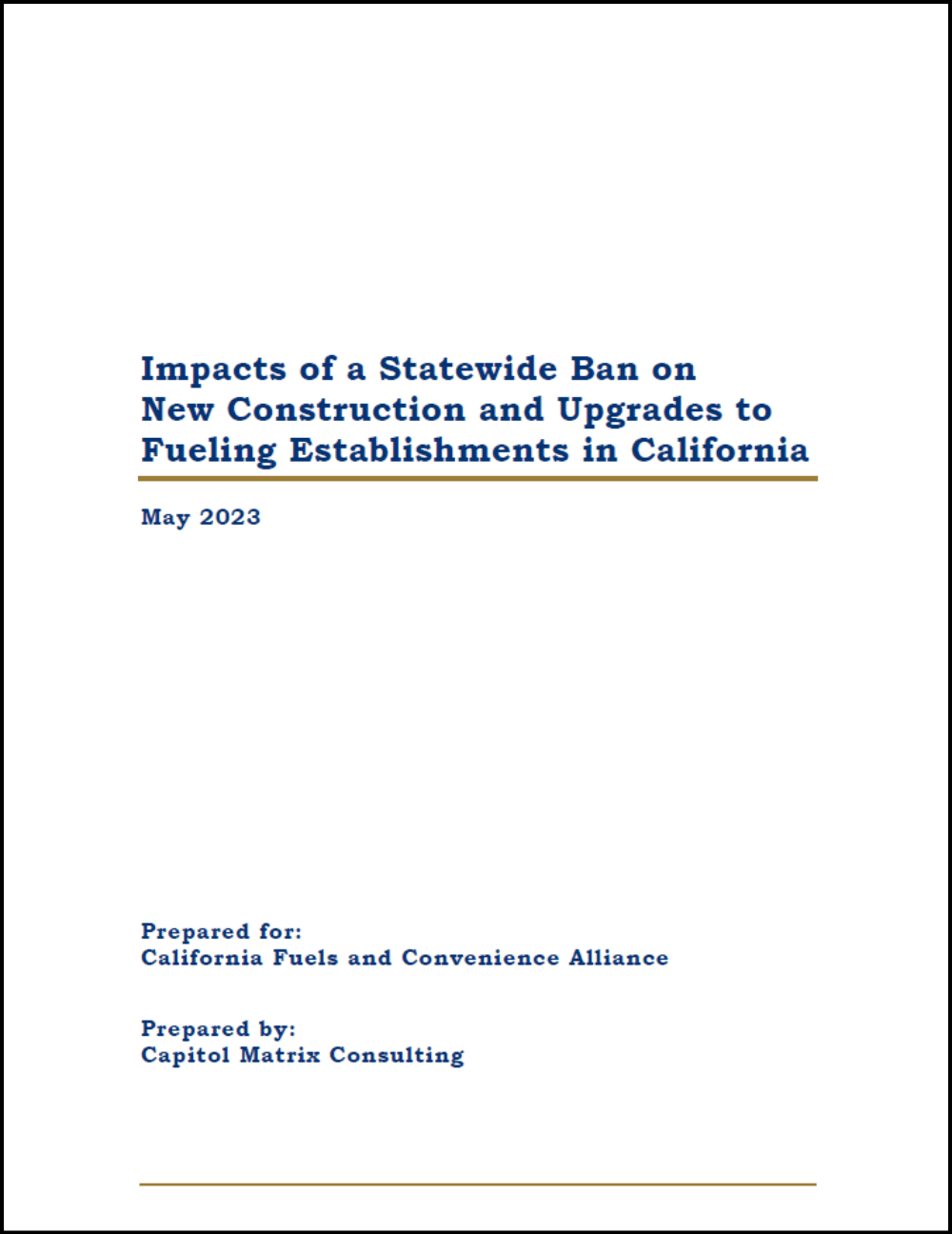

Did you know that California is home to more than 12,000 convenience stores and nearly 10,000 gas stations spread across the state?

Interestingly, almost 90% of these gas stations are owned and operated by independent business owners rather than by major oil companies. This means that the vast majority of fueling locations in California are run by local entrepreneurs who play a crucial role in serving communities while navigating a complex regulatory environment.

Gas stations and convenience stores provide employment for roughly 193,000 people across California. When you also include fuel delivery drivers and other roles connected to keeping our vehicles fueled, the total number of Californians working in this essential sector approaches 200,000.

Report for Impacts of a Statewide Ban on New Construction and Upgrades to Fueling Establishments in California

Written May 2023

Explore the essential role that the fuel industry plays in sustaining California’s communities, from supporting local economies and providing critical services to the economic impacts that adoption of a statewide ban or

widespread adoption of local bans would have on the California economy.

Read the key findings HERE